Bank of America Introduces New Digital Tools for Small Business

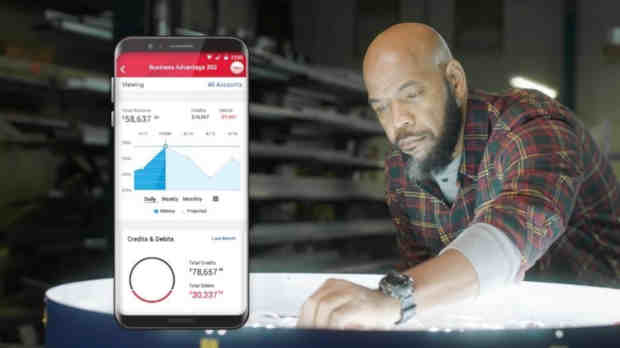

Bank of America introduced Wednesday (February 6) Business Advantage 360, a new digital dashboard designed to make it easier for entrepreneurs to manage the various financial aspects of their business.

Available for the first time to any Bank of America client with a business deposit account, Business Advantage 360 provides a complete view of business cash flow and access to real-time expertise and guidance – all in one simple tool with new functionality.

“Business Advantage 360 will help entrepreneurs save time and money, by providing a more complete financial picture of their business,” said Sharon Miller, managing director, head of small business at Bank of America. “This new feature is easily accessible on mobile devices, and will allow our clients to focus on the reasons they opened their business in the first place.”

| Download and Read RMN Publications | ||

| TechWise Today | The Integrity Bulletin | Clean Climate |

| Legal Directions | Young Learner | Real Voter |

Business Advantage 360 includes a variety of brand new capabilities to make it easier for entrepreneurs to manage their business, including:

- A new, streamlined view of key transactions, major expenses, credits and debits.

- Automatic cash flow projections based on scheduled transactions.

- Manually adjusting cash flow projections to account for additional data, such as new sales.

- Setting cash flow thresholds, creating time for proactive adjustments.

- The ability to connect with experienced small business bankers for guidance in just one click.

Future capabilities of the tool will deepen the cash flow insights, provide general market research and analysis, and enable clients to manage items such as payroll and human resources, payments and invoices, merchant services, tax accounting, goal-setting and forecasting.

Business Advantage 360 is built directly into the Bank of America online and mobile banking platforms, and will be available to all clients by the end of February. The no-cost tool does not require enrollment and is accessible through a link on the main pages of the Bank of America online and digital banking portals for small business clients.