Role of Digital in Entertainment & Media Industry

Increasing global sales of tablets and smart devices are underlining the rising revenue opportunities from digital delivery of entertainment and media (E&M) content and advertising to increasingly connected and mobile consumers.

According to PwC’s annual Global Entertainment and Media Outlook 2012-2016 – a five-year outlook for global consumer spending and advertising revenues directly related to entertainment and media content – released today, June 12, the industry is approaching the ‘end of the digital beginning’ with digital now embedded in business-as-usual and moving to the heart of many E&M companies.

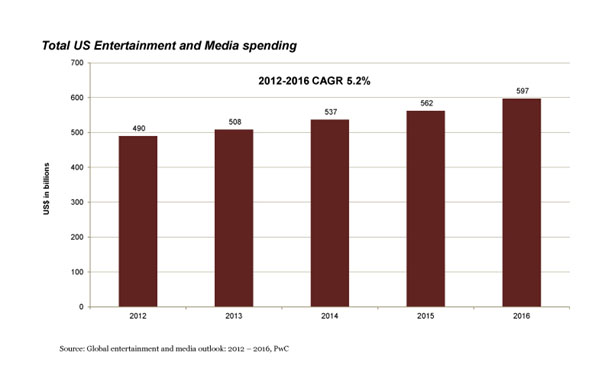

The Outlook forecasts that global E&M spending is expected to rise from $1.6 trillion in 2011 to $2.1 trillion by 2016, growing at a compound annual growth rate (CAGR) of 5.7 percent. The U.S. E&M market experienced the largest increase since 2007 with faster growth expected, growing at 5.2 percent CAGR reaching $597 billion in 2016, from $464 billion in 2011.

The report finds that growth in digital E&M spending will continue to significantly outpace growth in non-digital spending during the next five years. Digital spending is expected to account for 67 percent of all growth in spending during the next five years, globally. Digital spending in the U.S. is expected to account for 31.5 percent of all E&M spending in 2016, up from 21.7 percent in 2011.

“Change in consumer behavior is pervasive and accelerating and the E&M industry is in the front line of this change,” said Ken Sharkey, entertainment, media & communications US practice leader, PwC.

According to the Outlook, the challenge ahead is in the implementation of digital strategies and the E&M industry is reshaping itself around three perspectives:

Understanding the connected consumer – To engage and immerse consumers in the connected multi-screen future, companies need to understand their behaviors and motivations. Data analytics tools are required to mine the mass of customer data. However, consumers’ fears over privacy risk triggering a public and regulatory backlash. PwC believes that avoiding this will require a shift of industry mindset from ‘customer ownership’ to putting the ‘customer in control.’

New business models to reinvent the value proposition of advertising and content – Digitally derived insights are now redefining advertising and expanding its value proposition, enabling it to become paid, earned and socialized. This is driving new performance metrics, new roles for agencies and other participants in the value chain and new flexible pricing models.

Developing organizational models to harness new behaviors and grow revenues in the ‘new normal’ – To date, many E&M businesses have developed digital as an adjacent operating group, with separate infrastructure, solutions and staff. In the ‘new normal,’ this siloed approach no longer works. Companies are now embedding and integrating their digital operations into the main enterprise, driving improved profitability, scalability and innovation. Realizing these benefits means tackling challenges around right, royalties and piracy.

According to the Outlook, the rise of unpaid or earned media reflects an innovative new mix of advertising, content and analytics, bringing sweeping change to the roles and business models in advertising. The rise of socialization is feeding into the widely accepted concept of bought, owned and earned advertising among agencies and advertisers.

A fourth category is emerging – ‘managed’ advertising, which involves the orchestrated use of social media, such as engagement with bloggers. Everything that agencies do for their clients now has an embedded digital component with the attention on measurement shifted towards earned, unpaid media reach and purchasing intentions.

Overall, U.S. advertising is expected to increase at a 5.9 percent CAGR from $172 billion in 2011 to $229 billion in 2016, enhanced by Olympic and political advertising in 2016.

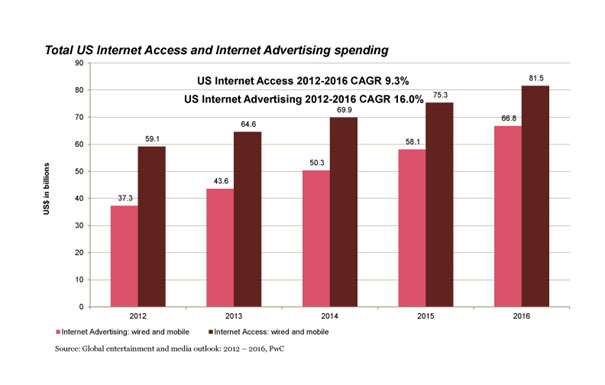

Internet advertising is expected to average 16 percent CAGR followed by video games, one of the smallest segments, at 11.4 percent CAGR.

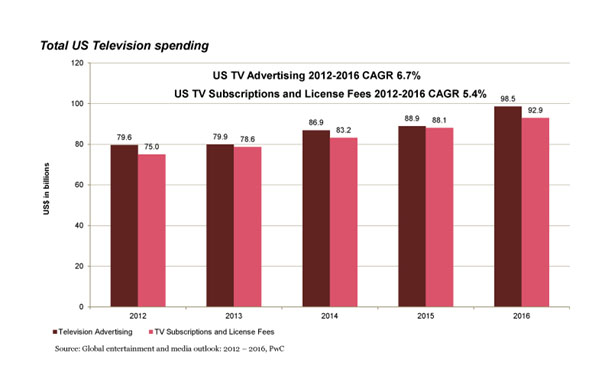

Television advertising, the largest segment, is expected to grow at 6.7 percent CAGR. Out-of-home advertising and cinema advertising are expected to grow by 4.9 percent and 4.5 percent CAGR, respectively. Newspaper advertising (-0.2 percent) is expected to be the only category to decline.

In the U.S., Internet advertising is expected to continue to outperform all other E&M segments, with double-digit gains of 16 percent CAGR. Recorded music will rebound with steady expansion projected rising at a 5.5 percent CAGR to $19.8 billion in 2016 from $15.2 billion in 2011.

Digital distribution of recorded music is expected to overtake physical distribution in 2012 and will rise at an 11.7 percent CAGR to $5.5 billion in 2016 from $3.1 billion in 2011.

PwC’s Global Entertainment and Media Outlook 2012-2016, the 13th annual edition, contains analysis and historical and forecast data for advertising and consumer/end-user spending in 13 major industry segments across 48 countries. You can find out more at http://www.pwc.com/outlook.

Segments covered by the Outlook include business-to-business, consumer and educational books, consumer magazine publishing, filmed entertainment, Internet access spending: wired and mobile, Internet advertising: wired and mobile, newspaper publishing, out-of-home advertising, radio, music, television advertising, TV Subscriptions and license fees and video games.

Digital spending consists of broadband and mobile Internet access; online and mobile Internet advertising; mobile TV subscriptions; digital music; electronic home video; online and wireless video games; digital consumer magazine circulation spending; digital newspaper circulation spending; digital trade magazine circulation spending; electronic consumer, educational, and professional books; and satellite radio subscriptions.

Historical information is obtained principally from confidential and proprietary sources. PwC analyzes recent trends in industry performance and identifies factors underlying those trends. Models are then developed to quantify the impact of each factor on industry spending. Forecasts are also based on an analysis of the dynamics of each segment in each region and on the factors that affect those dynamics.