Digital Ad Revenues in the U.S. to Grow 13%

In its newly released U.S. Local Media Forecast (2011-2016), media researcher BIA/Kelsey forecasts local online/interactive/digital advertising revenues to grow 13.1 percent in 2012.

According to the forecast, several local media segments are on target to exceed this overall growth rate, such as mobile search, which will grow 77.2 percent. Online video will grow 51.6 percent and social will grow 26.3 percent. For some media, like newspapers, digital ad revenues will be the only source of growth.

Meanwhile, Internet advertising revenues for the first quarter of 2012 set a new record for the reporting period at $8.4 billion, according to the latest IAB Internet Advertising Report from the Interactive Advertising Bureau (IAB) and PwC U.S. (Read: Internet Ad Revenues for Q1: $8.4 Billion)

“We continue to see a dramatic increase in spending on online media and it is fundamentally changing the media planning and buying process for advertisers,” said Mark Fratrik, vice president and chief economist, BIA/Kelsey.

[ Also Read: “Online Advertisers Can Pay Only for Actual Conversions” ]

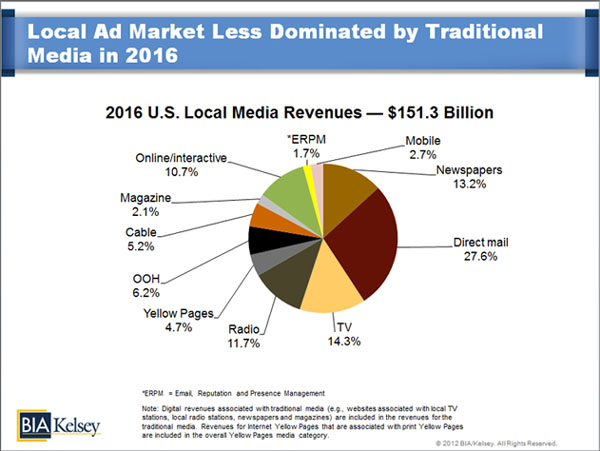

According to the forecast, the growth in different local media segments will drive an overall increase making digital over 25 percent of the local ad market. By 2016, it says, the total local media revenues will be $151.3 billion.

The U.S. Local Media Forecast (2011-2016): Full Edition examines the entire local media advertising marketplace. It includes a national overview of U.S. spending in local markets and individually forecasts top media segments (e.g., Newspapers, Radio, Video, Television: Over-the-Air & Cable, Out-of-Home, Direct Mail, Directories–Print and Internet Yellow Pages, Magazines, Online, Mobile, Social).

[ Also Read: Why You Should Not Advertise on Facebook ]

Released today, July 16, the forecast report details the expected compound annual growth rates (CAGRs) for specific digital media. Breakout media segments like mobile, video and social are reaping significant revenue from ad dollars.

For media segments like newspapers, established digital platforms are providing opportunities to migrate important sectors of advertising to online and offset negatives in the print portion of the business.

[ Also Read: Seven Tricks Digital Agencies Use to Cheat You ]

The CAGRs for the forecast period, 2011-2016, for digital/interactive revenues in key media segments are as follows: newspapers – online revenues: 5.0 percent; radio – online revenues: 11.8 percent; television – online revenues: 12.8 percent; digital out of home: 11.7 percent; online: 9.4 percent; mobile: 44.9 percent; Internet Yellow Pages: 12.5 percent; email, reputation and presence management: 14.9 percent; social media: 21.0 percent; and online video: 36.7 percent.

The report offers critical analysis and commentary and examines important topics in detail such as local versus national ad spend for mobile and social, video advertising revenues across media and social trends around Twitter, YouTube and LinkedIn.