Digital Banking or Digital Harassment? How Corporate Negligence Is Turning Technology into a Tool of Torture

RMN Digital Report Highlights:

🚨 ICICI Bank’s relentless KYC alerts expose how digital banking systems have degenerated into automated harassment, with customers repeatedly disturbed despite no change in their details.

🤖 Mindless automation without accountability has replaced human judgment, turning “digital convenience” into a source of stress, confusion, and daily disruption for consumers.

🔔 Contradictory messages like “Please ignore if KYC is already updated” reveal systemic incompetence, where banks themselves are unsure of their own records yet continue to penalize customers.

⚠️ This case is a warning for the digital economy, showing how corporate negligence and poorly governed technology can erode trust, privacy, and mental peace instead of improving services.

By Rakesh Raman

New Delhi | December 26, 2025

Digital banking was sold to citizens as a promise — of efficiency, convenience, speed, and respect for customers’ time. Instead, what many consumers are experiencing today is something far more disturbing: automated harassment, algorithmic incompetence, and complete corporate indifference.

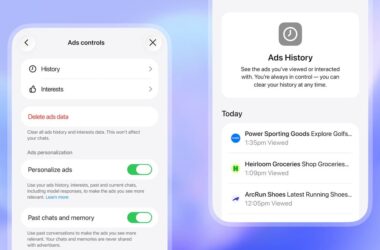

For weeks — including today, December 26 — ICICI Bank has continued to bombard me with repetitive, ugly, and often contradictory KYC messages on email and mobile phone. These messages arrive with shrill notification alerts, without context, without clarity, and without resolution. Despite repeated complaints, explanations, and public exposure, the harassment continues unabated.

This is not a technical glitch.

This is institutional negligence powered by bad technology and worse governance.

When “Digital” Means Dumb Automation

The core problem with modern digital banking is not technology itself — it is mindless automation without accountability.

Banks deploy automated systems that:

-

Do not know whether a customer’s KYC is already updated

-

Do not distinguish between different account types

-

Do not stop messaging even after complaints are acknowledged

-

Do not provide a simple opt-out or confirmation mechanism

Instead, customers receive messages ending with the absurd disclaimer:

“Please ignore if KYC is already updated.”

If the bank itself does not know whether KYC is updated, why is the customer being punished for the bank’s incompetence?

This is not digitisation.

This is outsourcing thinking to broken software.

Digital Banking Has Become a One-Way Street

In theory, digital banking empowers customers.

In reality, it has created a power imbalance where:

-

Banks can disturb customers endlessly

-

Customers have no effective way to stop the disturbance

-

Human accountability is replaced by call-center scripts

-

Responsibility is diluted across systems, bots, and departments

The customer is expected to comply.

The bank is never expected to explain.

This is digital authoritarianism in corporate form.

The Myth of “Customer-Centric” Banking

Banks loudly advertise:

-

“Customer-first”

-

“Digital excellence”

-

“Service quality”

-

“AI-powered banking”

Yet when customers raise legitimate concerns, they are:

-

Redirected to branches in a supposedly digital age

-

Asked to meet relationship managers for automated issues

-

Given templated replies unrelated to the actual complaint

In my case, the bank even responded about a different account that had no KYC issue at all, while continuing to harass me about the actual account under dispute.

This exposes a deeper truth:

Digital banking systems are poorly designed, poorly monitored, and shielded from consequences.

The Human Cost of Corporate Automation

For professionals, journalists, researchers, senior citizens, and small business owners, constant digital disruption is not a minor inconvenience — it is mental harassment.

Unsolicited alerts:

-

Break concentration

-

Interrupt work

-

Create anxiety

-

Waste productive hours

In a country where individuals are already battling information overload, such persistent digital noise becomes a form of psychological pressure — imposed not by criminals, but by regulated corporations.

Privacy Without Peace Is Meaningless

Banks routinely claim they respect customer privacy.

But privacy is not just about data storage — it is also about freedom from unnecessary intrusion.

When a bank repeatedly contacts a customer without justification, clarity, or resolution, it violates:

-

The spirit of data protection

-

Consumer protection norms

-

Basic standards of professional conduct

Digital systems should reduce friction — not institutionalize harassment.

A Larger Warning for the Digital Economy

The ICICI Bank episode is not an isolated incident. It is a warning signal for the entire digital economy.

When:

-

Automation replaces judgment

-

Compliance replaces common sense

-

Customers are treated as data points, not humans

Digital transformation turns into digital oppression.

Unless banks and regulators urgently redesign systems with:

-

Clear logic

-

Human override

-

Accountability loops

-

Consent-based communication

Digital banking will continue to erode trust instead of building it.

RMN Consumer Rights Network: Pushing Back Against Digital Abuse

Through the RMN Consumer Rights Network, these patterns of corporate negligence are being documented, reported, and escalated.

Digital convenience cannot come at the cost of:

-

Dignity

-

Peace

-

Time

-

Mental well-being

Technology must serve people — not terrorize them with endless alerts and bureaucratic indifference.

Stop Calling It Digital Banking

What banks are practicing today is not digital banking.

It is lazy automation backed by institutional arrogance.

Until corporations are held accountable for the harm caused by their digital systems, consumers will continue to suffer — silently, repeatedly, and pointlessly.

Digital progress without responsibility is not innovation.

It is corporate negligence at scale.

By Rakesh Raman, who is a national award-winning journalist and social activist. He is the founder of a humanitarian organization RMN Foundation which is working in diverse areas to help the disadvantaged and distressed people in the society.

As a technology and AI expert, his professional focus is on applying emerging AI and digital technologies to enhance decision-making, operational efficiency, transparency, and democratic participation in governance, media, and business systems. You can click here to view his full profile.