Nvidia CEO Confirms “Largest Yet” Investment in OpenAI, Dismissing Reports of Internal Friction

The primary objective of this capital influx is to support a massive expansion of AI infrastructure.

RMN Digital Corporate Desk

New Delhi | February 1, 2026

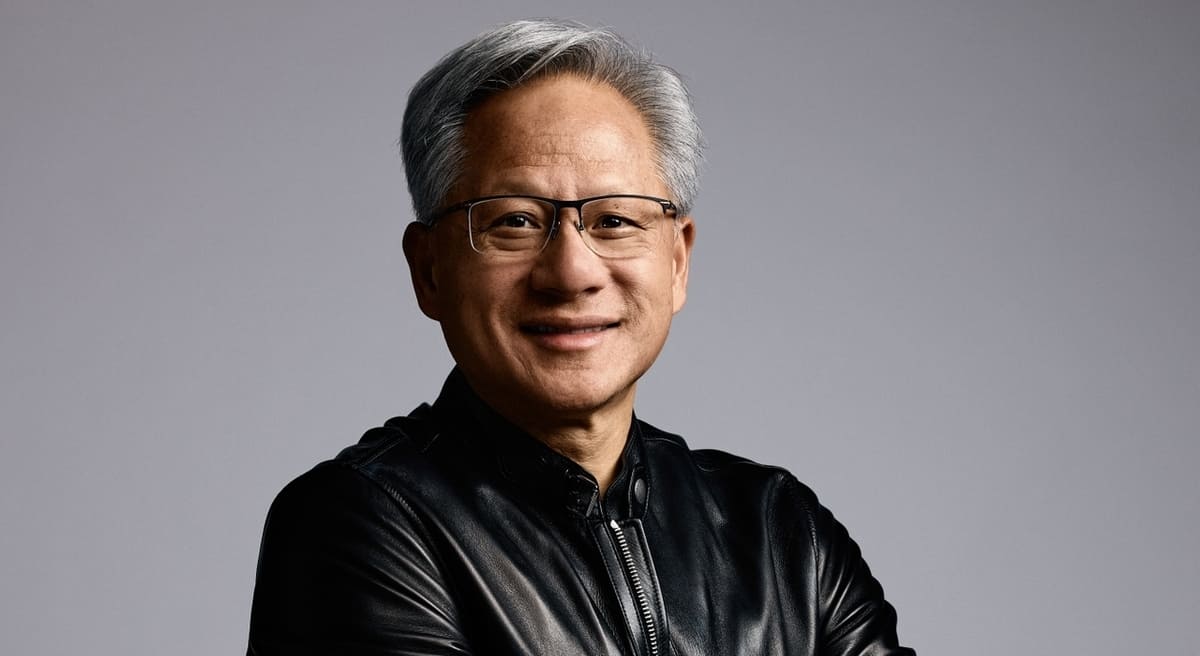

In a major move to solidify the future of artificial intelligence infrastructure, Nvidia CEO Jensen Huang confirmed on January 31, 2026, that his company will participate in OpenAI’s latest funding round, describing the commitment as potentially the “largest investment we’ve ever made”. Speaking to reporters and suppliers in Taipei, Huang lauded OpenAI as “one of the most consequential companies of our time” and expressed strong confidence in the organization’s trajectory.

Refuting Friction and Circularity Concerns

The announcement serves as a direct rebuttal to a recent Wall Street Journal report claiming that a proposed $100 billion partnership between the two tech giants had stalled due to internal doubts and concerns regarding OpenAI’s business discipline. Huang explicitly labeled these reports “nonsense,” clarifying that while Nvidia’s contribution is “huge,” it will be “nothing like” the $100 billion figure previously speculated.

This massive commitment comes amid growing industry scrutiny regarding “circular” AI deals, where tech leaders invest in the very companies that are primary purchasers of their high-end chips. Nvidia recently executed a similar strategic move by investing an additional $2 billion in CoreWeave, another key customer and cloud-computing provider.

The Race for $100 Billion in Capital

OpenAI is currently seeking to raise as much as $100 billion in total capital, a round that could value the startup between $750 billion and $830 billion. Nvidia is joined by several other high-profile participants:

- Amazon is reportedly in advanced talks to contribute as much as $50 billion.

- Microsoft and SoftBank Group Corp are also expected to participate in the financing.

- CEO Sam Altman has sought further backing from top investors in the Middle East to secure the round.

Infrastructure and the Path to IPO

The primary objective of this capital influx is to support a massive expansion of AI infrastructure. This includes a strategic initiative to deploy 10 gigawatts of computing power—enough to match the peak electricity demand of New York City—specifically designed to train and deploy next-generation models like GPT-6. This effort ties into “Stargate,” a $500 billion American AI initiative. As part of this broader push, OpenAI and SoftBank recently announced a $1 billion joint investment in SB Energy to accelerate the development of data center campuses.

Despite the influx of capital, OpenAI faces significant financial headwinds, with projected losses of $14 billion in 2026 and a cumulative deficit that could reach $115 billion by 2029. To secure long-term stability and compete with rivals like Anthropic, the company is targeting an Initial Public Offering (IPO) in the fourth quarter of 2026. To facilitate this transition, OpenAI has restructured as a Public Benefit Corporation (PBC), aiming to balance its massive commercial growth with the safe development of artificial general intelligence.